rank real estate asset classes by risk

So a more complete list of four asset classes is. 51 open jobs for Commercial real estate in Marlboro.

Asset Classes Explained Understanding Investments Unisuper

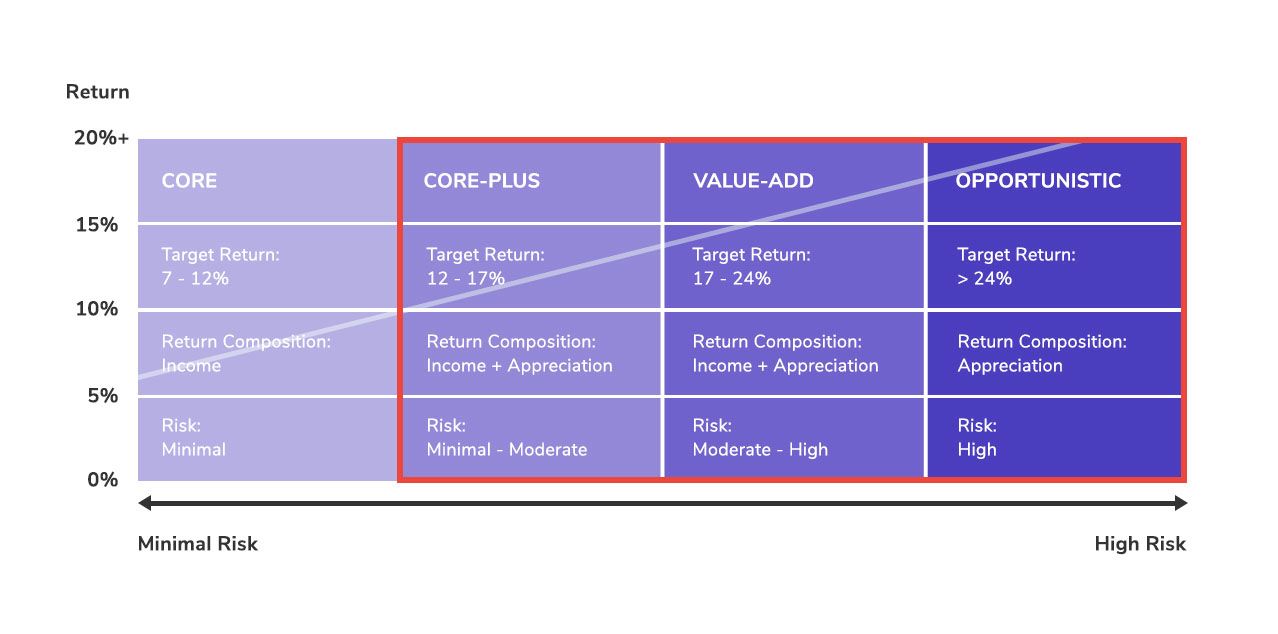

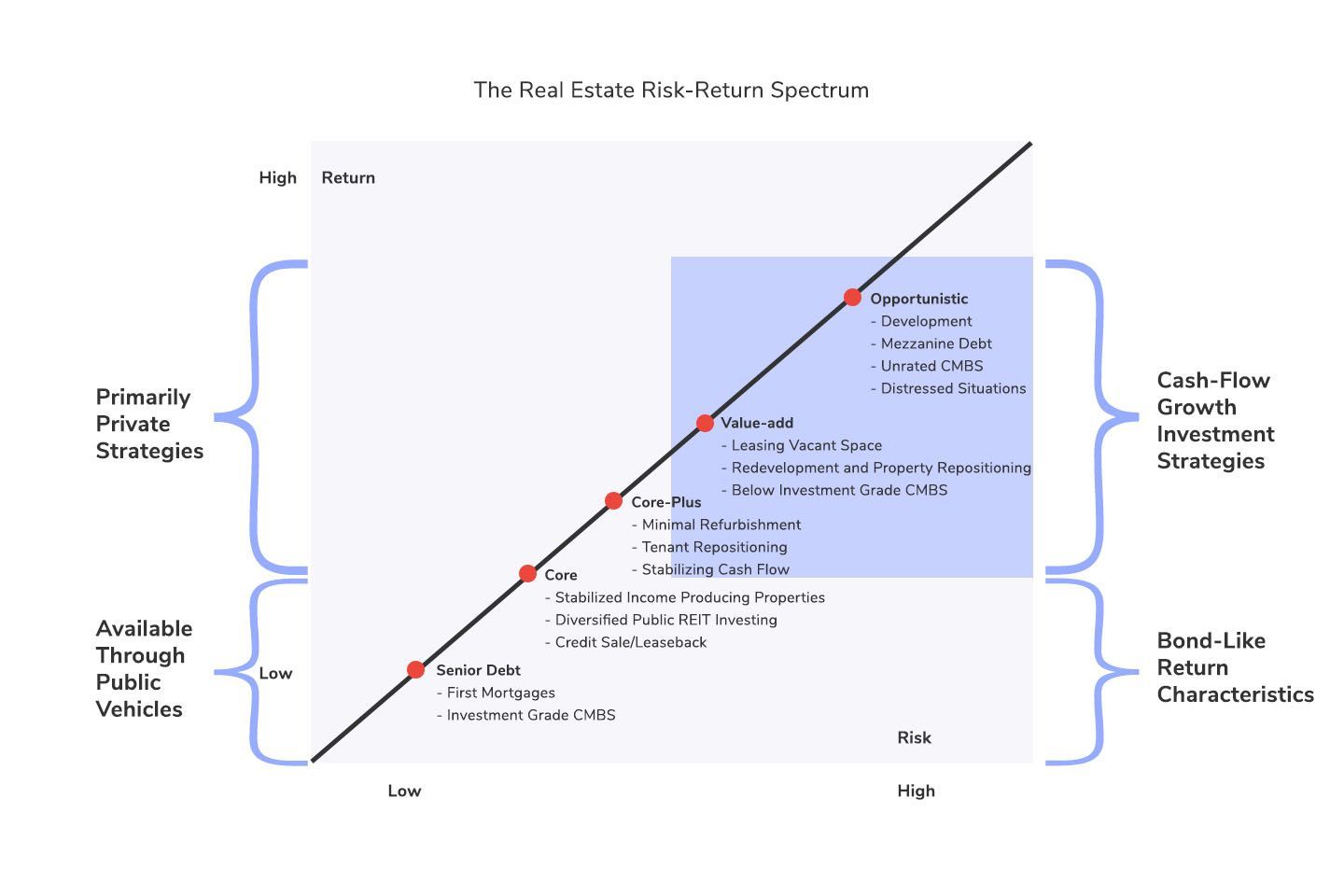

The sacred cow of real estate asset classes has consistently been core assets such as retail office and Class A multifamily.

. Management company organization and the role and. Of a generally conservative asset allocation. Many sources list individual types of alternative.

The biggest mistake is failing to create a plan in the first place. Ad Invest in diverse asset classes from multifamily industrial retail more on CrowdStreet. Ad Browse discover thousands of brands.

Within alternatives real estate is the main asset class in all markets except for the US where private equity accounts for a larger share of the. Buy Homes without Banks. Direct Access Real Estate Funding.

A real estate investment trust is a company that owns operates or finances income-producing real estate. Sign up for a free account today to access our live commercial real estate funds. Learn the Secrets of Smart Investing.

Ad Properly drafted estate plan does more than merely specifying what happens to your assets. Ad Invest with 0 Down. Real estate risk spectrum.

The primary concentration in Real Estate is comprised of 5 courses 15 credits in total 4 required courses and 1 elective. Heres how total returns stack up by property sector sorted from. The firm has over 552 million in assets under management and helps clients achieve their goals through a disciplined holistic approach to accumulating protecting and.

The first asset class is real estate. No Credit or Savings Needed. Part-Time MBA concentration in Real Estate.

From asset management to development and everything in between be prepared with the skills you need for a thriving career with a Rutgers. Equities stocks Fixed income bonds Cash and cash equivalents. Free shipping on qualified orders.

Real estate has the highest risk and the highest. Read customer reviews find best sellers. However workforce multifamily has historically.

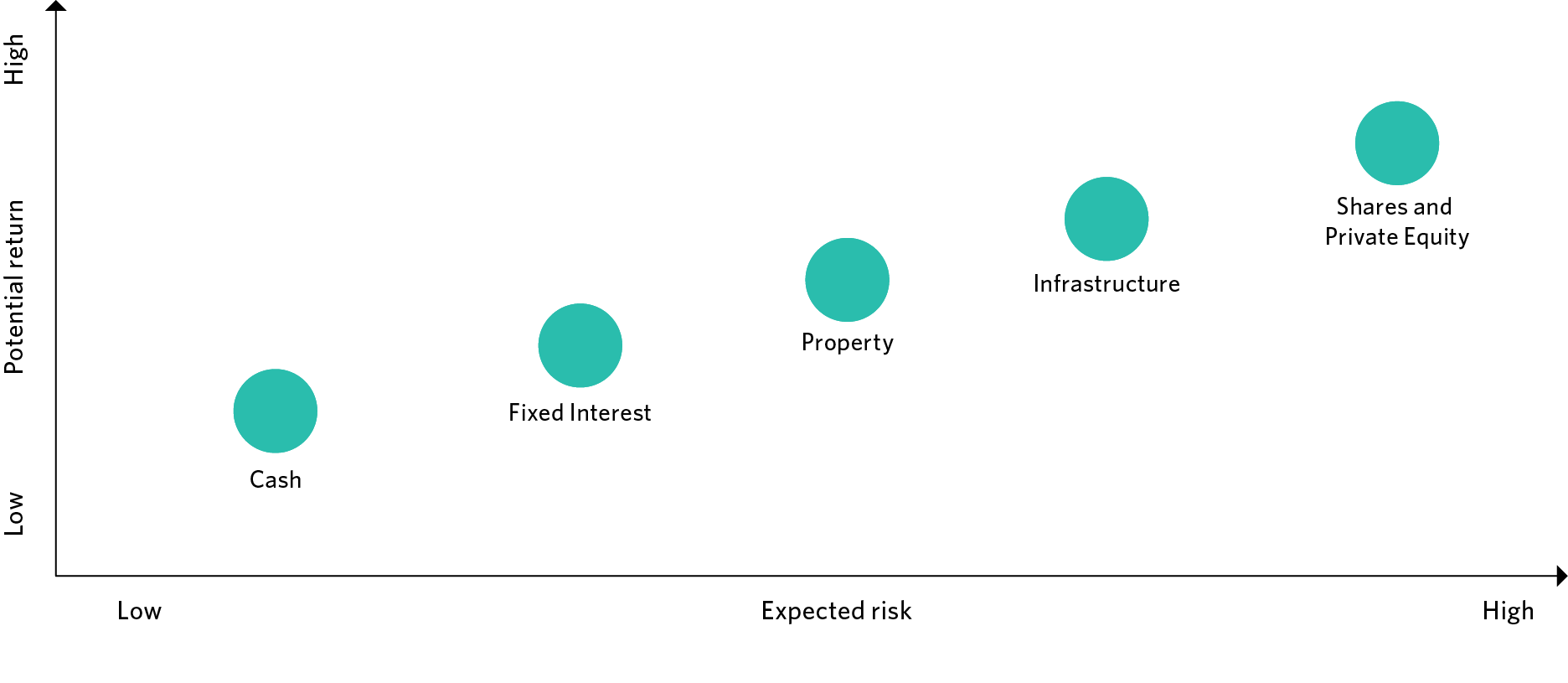

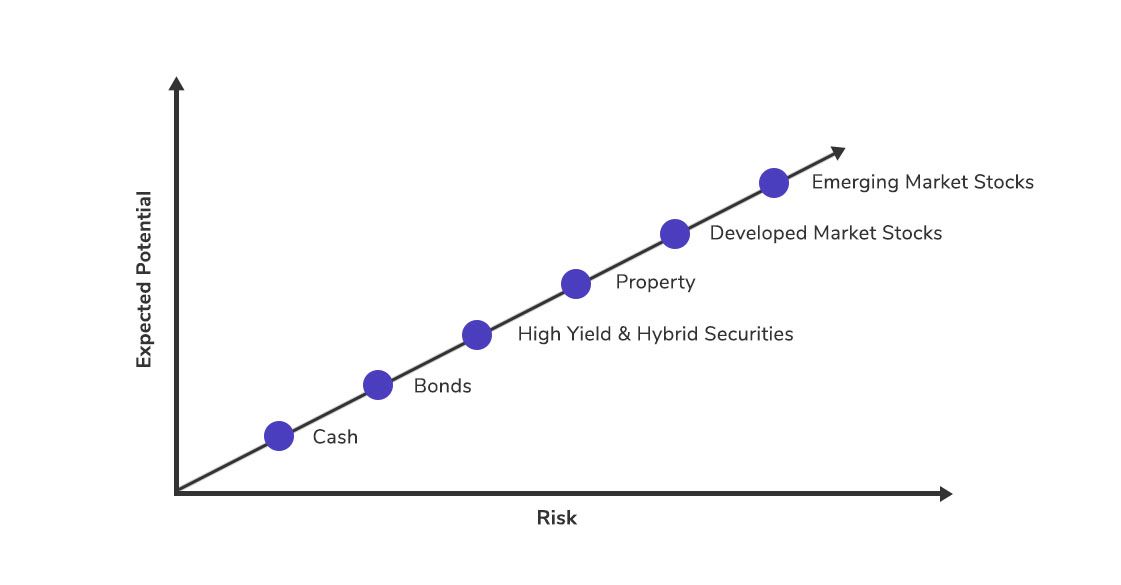

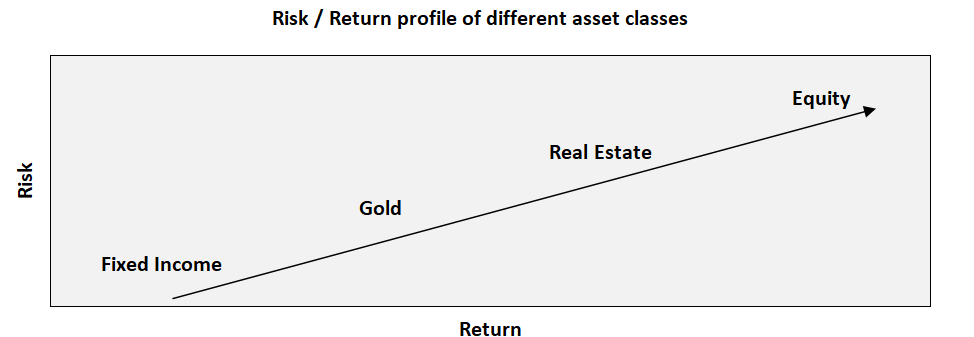

The real estate investment industry had established a set of common terminologies for classifying investment strategies and their typical risk-return. Here are the types of asset classes ranging from high risk with high return to low risk with low return. Free easy returns on millions of items.

Search Commercial real estate jobs in Marlboro NJ with company ratings salaries.

The Real Estate Risk Reward Spectrum Investment Strategies

Alternative Assets How Much Will They Grow By 2025

How Housing Became The World S Biggest Asset Class The Economist

The Opportunity In Private Real Assets Institutional Investor

Real Estate Private Equity Career Guide

The Opportunity In Private Real Assets Institutional Investor

Rethinking Asset Allocation Kkr

The Real Estate Risk Reward Spectrum Investment Strategies

Rethinking Asset Allocation Kkr

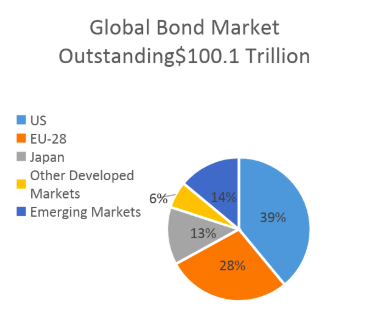

Part Ii On Asset Classes Size Of Markets And Trading Volumes By Les Nemethy And Sergey Glekov Europhoenix

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

The Real Estate Risk Reward Spectrum Investment Strategies

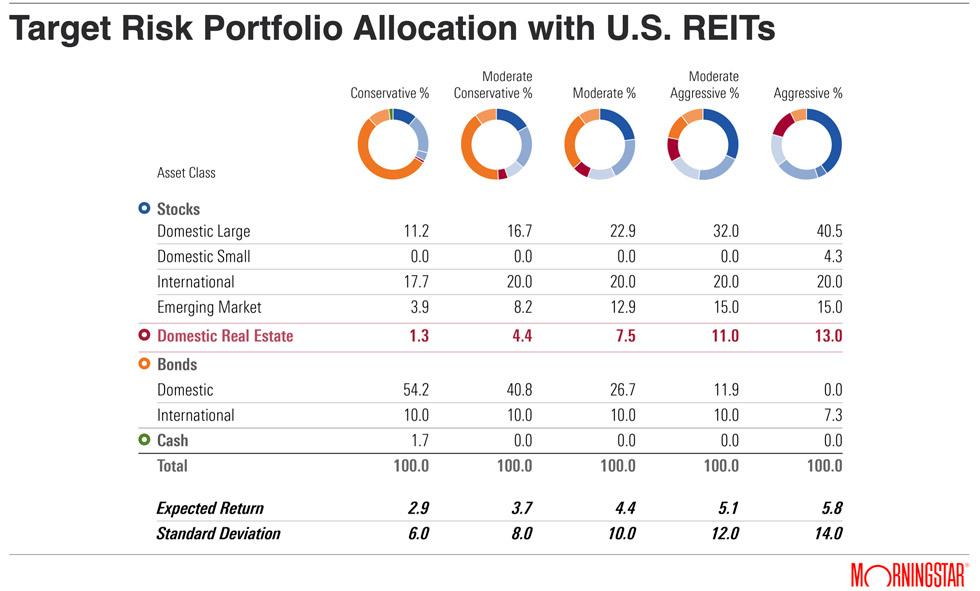

New Morningstar Analysis Shows The Optimal Allocation To Reits Nareit

Benefits Of Equity Mutual Funds Over Other Asset Classes Mirae Asset

:max_bytes(150000):strip_icc()/DeterminingRiskandtheRiskPyramid3-1cc4e411548c431aa97ac24bea046770.png)

/AchieveOptimalAssetAllocation-02-0e9eaa2219934b4cb85c48fb9db7b45c.png)